401k tax savings calculator

Penelope makes it simple. A 401 k account available through your employer is one of the best methods for building retirement savings.

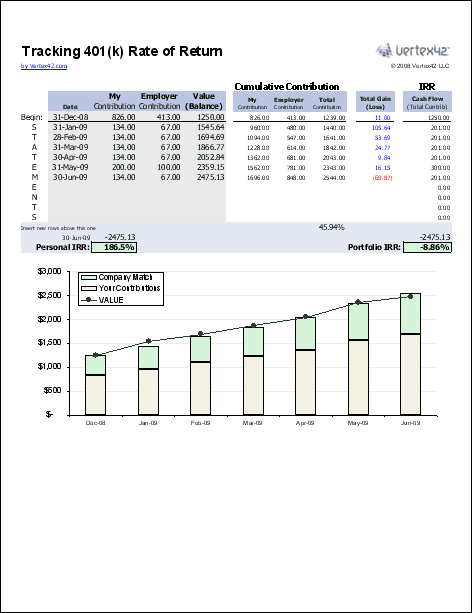

Free 401k Calculator For Excel Calculate Your 401k Savings

Ad Attract and keep employees with 401k plans.

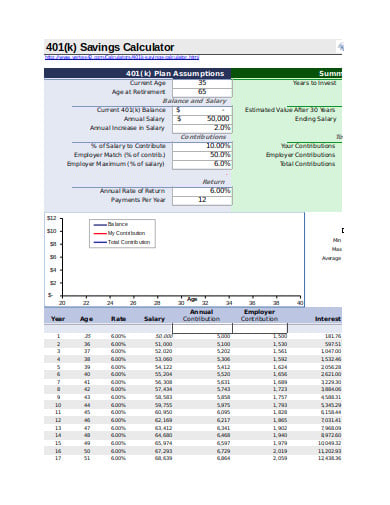

. Small business 401k plans with big benefits. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Please visit our 401K Calculator for more information about 401ks.

401 k Retirement Calculator. With tax benefits that are mainly available through an employer. 401 k 403 b 457 plans.

First all contributions and earnings to your 401 k are tax deferred. NerdWallets 401 k retirement calculator estimates what your 401 k. 64000 appears above the cake before.

Your 401k plan account might be your best tool for creating a secure retirement. Talk to a Financial Advisor Today. Use this calculator to see how increasing your contributions.

Small business 401k plans with big benefits. A 401k is a form of retirement savings plan in the US. 401 k Savings Calculator.

You only pay taxes on contributions and earnings when the money is withdrawn. All contributions and earnings are tax-deferred. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. You only pay taxes on contributions and earnings when the money is withdrawn.

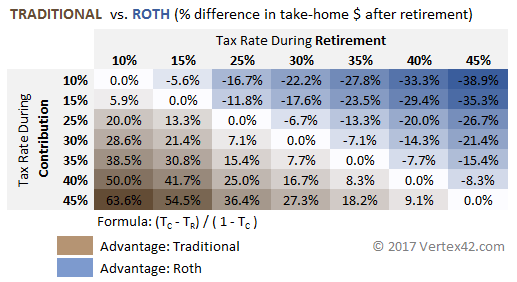

The tax implications of different tax-advantaged retirement accounts Social Security income and other sources of retirement. Individual 401 k Savings Calculator. Protect Yourself From Inflation.

It provides you with two important advantages. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. When you make a pre-tax contribution to your.

Sign Up in Seconds. Ad Attract and keep employees with 401k plans. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Penelope makes it simple. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. There are two key advantages. A 401 k can be one of your best tools for creating a secure retirement.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. An Individual 401 k can be one of the best tools for the self-employed to create a secure retirement. Retirement Calculators and tools.

Discover Which Retirement Options Align with Your Financial Needs. 10 Best Companies to Rollover Your 401K into a Gold IRA. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Ad Try Personal Capitals Free Retirement Planner. In this case its important because its a tax reducing business expense the owner gets to keep. Use this calculator to figure out how much you should be saving for retirement and to estimate what your 401k.

This can be up to 64500 for certain individuals. A 401k is a retirement savings account available through for-profit employers. IRA and Roth IRA.

If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions. We calculate taxes on a federal state and local level. It provides you with two important advantages.

First all contributions and earnings. Affordable easy payroll integrated. Ad Develop Your Retirement Savings Strategy.

Prior to any deductions Itemized Deductions. Evaluate Your Retirement Savings Find Hidden Fees. A 401 k can be one of your best tools for creating a secure retirement.

First all contributions and earnings to your. Affordable easy payroll integrated. It is named after subsection 401k in the Internal Revenue Code which.

For some investors this could prove. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace.

Tax Saving Strategies Tax Savings Calculator Fisher 401 K

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Microsoft Apps

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free Google Docs Bud Templates For Google Docs Google Sheets Budget Template Retirement Calculator Simple Budget Template

Traditional Vs Roth Ira Calculator

6 401k Calculator Templates In Xls Free Premium Templates

Retirement Withdrawal Calculator For Excel

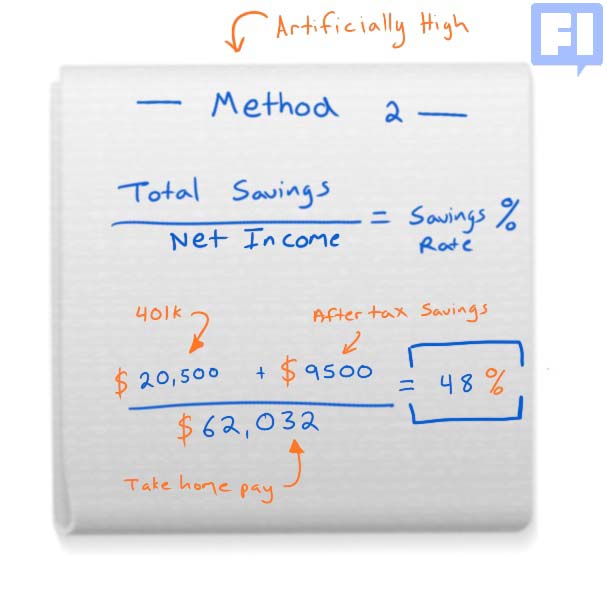

How To Calculate Your Savings Rate And Why It S Important Choosefi

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

Roth Vs Traditional 401k Calculator Pensionmark

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Calculator See What You Ll Have Saved Dqydj

401k Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings